Dear Colleagues,

On January 1, 2024, amendments to the Tax Code of the Russian Federation relating to transfer pricing will come into force. The adopted amendments will apply to transactions made from 01.01.2024 and onwards, unless “otherwise provided for by a regulatory legal act of the President of the Russian Federation”.

The following key amendments were made to the Transfer Pricing Rules

- The criteria for interdependence have been expanded;

- The criteria for recognizing transactions as controlled are amended;

- Introduced a rule on the use of the median value within the transfer pricing of inspections;

- Introduces a rule on the recognition of transfer pricing adjustments to dividends on transactions with foreigners;

- Expands requirements for the disclosure by Russian taxpayers of information concerning controlled transactions;

- New penalties for violations are introduced, and existing fines are increased.

- Expanded opportunities for concluding Pricing Agreements

- “Safe” intervals under Article 269 of the Tax Code of the Russian Federation have been changed

1. Expanding the criteria for interdependence

Expands the list of persons recognized as interdependent in accordance with paragraph 2 of Article 105.1 of the Tax Code of the Russian Federation. Now interdependent will also be recognized as interdependent:

1.1 Organizations, if the same individual (or together with related private individuals):

1.3 Controlled foreign companies if they have one controlling person (subparagraph 14, paragraph 2, Article 105.1 of the Tax Code).

These amendments were adopted in order to bring the rules for recognizing interdependence (controllability) for tax purposes (under both the CFC and transfer pricing rules) into line.

Expands the list of persons recognized as interdependent in accordance with paragraph 2 of Article 105.1 of the Tax Code of the Russian Federation. Now interdependent will also be recognized as interdependent:

1.1 Organizations, if the same individual (or together with related private individuals):

- has a direct (indirect) interest in these organizations of more than 25%, or.have the authority to appoint (elect) the sole executive body of these organizations,

- or have the authority to appoint (elect) at least 50% of the collegial executive body or the board of directors (supervisory board) of organizations (subparagraph 12, paragraph 2, Article 105.1 of the Tax Code of the Russian Federation);

1.3 Controlled foreign companies if they have one controlling person (subparagraph 14, paragraph 2, Article 105.1 of the Tax Code).

These amendments were adopted in order to bring the rules for recognizing interdependence (controllability) for tax purposes (under both the CFC and transfer pricing rules) into line.

2.Changes in the criteria for recognizing transactions as controlled transactions

The amount of income to recognize transactions as controlled has been increased.

The transactions shall be recognized as controlled if the amount of income from them with a person(s) from offshore jurisdictions or with a foreign interdependent person for a calendar year exceeds 120 million roubles.

The amount of income to recognize transactions as controlled has been increased.

The transactions shall be recognized as controlled if the amount of income from them with a person(s) from offshore jurisdictions or with a foreign interdependent person for a calendar year exceeds 120 million roubles.

As of January 1, 2024, the list of transactions which under no circumstances are recognized as controlled transactions has been expanded.

These include, in particular, transactions that simultaneously meet the following criteria:

These include, in particular, transactions that simultaneously meet the following criteria:

- one of the parties to the transaction is an organization for which the place of registration or tax residence is a foreign state (territory);

- a treaty (agreement, convention) on avoidance of double taxation, which was previously concluded with such state (territory), is suspended in accordance with the Decree of the President of the Russian Federation;

- the transaction was made on the basis of a contract (agreement) concluded before March 1, 2022;

- the order of price determination and (or) pricing methods (formulas) applied in this transaction has not been changed after March 1, 2022;

- the transaction does not meet the conditions for recognizing transactions as controlled in accordance with paragraphs 1, 3, Art. 105.14 of the Tax Code of the Russian Federation. 1, 3 of Article 105.14 of the Tax Code of the Russian Federation.

3.Use of median value within the framework of price audits by the Federal Tax Service of Russia

Where a supervisory tax authority establishes that transactions between related parties are carried out at non-market prices, the relevant authority will have the right to increase the transaction price independently.

In this case, the price of the deal will be increased to the median value of the market price interval.

It should be noted that the median value should be applied only if such option will not reduce the amount of tax payable (paragraphs 5, 7 of Art. 105.9, paragraphs 5, 7 of Art. 105.10 of the Tax Code of the Russian Federation – the tax authorities will apply the median value for additional tax assessments under any of the five methods).

However, a taxpayer may use the minimum or maximum value of the market price/profitability interval if the taxpayer has decided to make an independent adjustment of the tax base or the amount of loss in accordance with paragraph 6 of Article 105.3 of the Tax Code and the counterparty to the transaction has returned the relevant amount of funds to Russia.

Where a supervisory tax authority establishes that transactions between related parties are carried out at non-market prices, the relevant authority will have the right to increase the transaction price independently.

In this case, the price of the deal will be increased to the median value of the market price interval.

It should be noted that the median value should be applied only if such option will not reduce the amount of tax payable (paragraphs 5, 7 of Art. 105.9, paragraphs 5, 7 of Art. 105.10 of the Tax Code of the Russian Federation – the tax authorities will apply the median value for additional tax assessments under any of the five methods).

However, a taxpayer may use the minimum or maximum value of the market price/profitability interval if the taxpayer has decided to make an independent adjustment of the tax base or the amount of loss in accordance with paragraph 6 of Article 105.3 of the Tax Code and the counterparty to the transaction has returned the relevant amount of funds to Russia.

4. Introduction of “secondary” adjustment for cross-border transactions

The law introduces a “secondary” adjustment rule.

The conclusion of a transaction using non-market prices between interdependent persons, one of whom is not a Russian tax resident, gives rise to income from a source in the Russian Federation for the latter and is equated with the payment of dividends for taxation purposes. This gives rise to a non-resident's tax obligation to calculate and pay tax. The date on which income equivalent to dividends is received is determined by the last day of the calendar year in which the transaction between related parties took place. An important condition for the application of this provision is such a difference in transaction prices, which resulted in adjustments to the resident taxpayer's tax base for the relevant taxes. And if a non-resident returns income received as a result of an adjustment of the tax base by crediting it to the account of a resident taxpayer, the provision is inapplicable. The detailed procedure and conditions for such a refund are set out in paragraph 6.2 of Article 105.3 of the Tax Code.

The peculiarity of this amendment is not only the qualification of non-resident income as dividends, but also the possibility of adjusting the tax base due to deviations from market prices (in relation to taxes on income of foreign individuals).

5. Expansion of disclosure requirements for controlled transactions

Transfer pricing documentation is now mandatory to be submitted on a regular basis.

For example, transfer pricing documentation will now need to disclose information on the foreign counterparty's income and expenses, asset value and number of employees.

Members of international groups of companies (IGCs) may also face additional requirements, very special if the main assets of such an IGC are located in Russia.

The law introduces a “secondary” adjustment rule.

The conclusion of a transaction using non-market prices between interdependent persons, one of whom is not a Russian tax resident, gives rise to income from a source in the Russian Federation for the latter and is equated with the payment of dividends for taxation purposes. This gives rise to a non-resident's tax obligation to calculate and pay tax. The date on which income equivalent to dividends is received is determined by the last day of the calendar year in which the transaction between related parties took place. An important condition for the application of this provision is such a difference in transaction prices, which resulted in adjustments to the resident taxpayer's tax base for the relevant taxes. And if a non-resident returns income received as a result of an adjustment of the tax base by crediting it to the account of a resident taxpayer, the provision is inapplicable. The detailed procedure and conditions for such a refund are set out in paragraph 6.2 of Article 105.3 of the Tax Code.

The peculiarity of this amendment is not only the qualification of non-resident income as dividends, but also the possibility of adjusting the tax base due to deviations from market prices (in relation to taxes on income of foreign individuals).

5. Expansion of disclosure requirements for controlled transactions

Transfer pricing documentation is now mandatory to be submitted on a regular basis.

For example, transfer pricing documentation will now need to disclose information on the foreign counterparty's income and expenses, asset value and number of employees.

Members of international groups of companies (IGCs) may also face additional requirements, very special if the main assets of such an IGC are located in Russia.

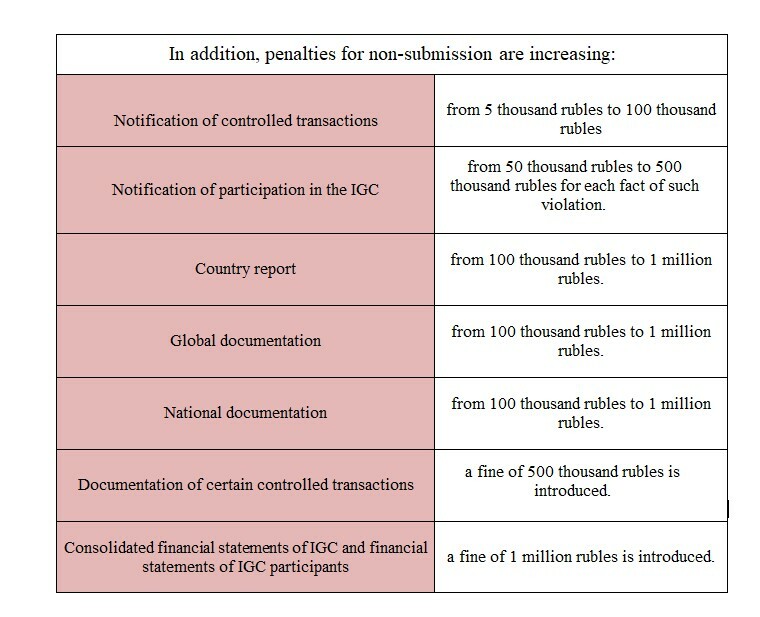

6. Introduction of new penalties for violations and increase in existing fines

The amount of fines for the use of prices in controlled transactions that do not correspond to market prices is set at the following amount (Article 129.3 of the Tax Code of the Russian Federation):

The amount of fines for the use of prices in controlled transactions that do not correspond to market prices is set at the following amount (Article 129.3 of the Tax Code of the Russian Federation):

- the penalty for the use of non-market prices in domestic controlled transactions remains unchanged and will amount to 40% of the unpaid tax amount, but not less than RUB 30,000. The exemption from the penalty for submitting documentation to the transfer pricing continues to apply.

- penalty for the use of non-market prices in controlled transactions with foreign related parties, in transactions with foreign trade goods (from the list of the Ministry of Industry and Trade of Russia) or in transactions with counterparties from the “black” list of the Ministry of Finance of Russia – set in the amount of 100% of the aggregate amount of tax arrears (additional income tax and withholding tax on dividends based on the results of the secondary adjustment), but not less than 500 thousand rubles.

7. Expansion of Pricing Agreements

Transfer pricing audits, penalties and additional assessments can be avoided if the taxpayer has a Pricing Agreement in place with the tax authority.

The law has improved the procedure for concluding Pricing Agreement.

Thus, the Pricing Agreement becomes available to taxpayers (including those that are not the largest) in respect of controlled transactions where the sum of income (expenses) amounted to at least 2 billion rubles for a calendar year and the subject of which are commodity groups specified in paragraph 5 of Article 105.14 of the Tax Code of the Russian Federation (List of the Ministry of Industry and Trade) (paragraph 1 of Article 105.19 of the Tax Code).

It becomes possible to conclude a Pricing Agreement for up to five years, including the inclusion in the perimeter of the agreement of transactions made within two years preceding the year of application for the conclusion of the agreement (Paragraph 1 of Article 105.21 of the Tax Code of the Russian Federation).

The duty provided for consideration of an application for the conclusion of a Pricing Agreement is reduced from RUB 2 million to RUB 1 million (subparagraph 133, paragraph 1, Article 333.33 of the Tax Code of the Russian Federation)

Transfer pricing audits, penalties and additional assessments can be avoided if the taxpayer has a Pricing Agreement in place with the tax authority.

The law has improved the procedure for concluding Pricing Agreement.

Thus, the Pricing Agreement becomes available to taxpayers (including those that are not the largest) in respect of controlled transactions where the sum of income (expenses) amounted to at least 2 billion rubles for a calendar year and the subject of which are commodity groups specified in paragraph 5 of Article 105.14 of the Tax Code of the Russian Federation (List of the Ministry of Industry and Trade) (paragraph 1 of Article 105.19 of the Tax Code).

It becomes possible to conclude a Pricing Agreement for up to five years, including the inclusion in the perimeter of the agreement of transactions made within two years preceding the year of application for the conclusion of the agreement (Paragraph 1 of Article 105.21 of the Tax Code of the Russian Federation).

The duty provided for consideration of an application for the conclusion of a Pricing Agreement is reduced from RUB 2 million to RUB 1 million (subparagraph 133, paragraph 1, Article 333.33 of the Tax Code of the Russian Federation)

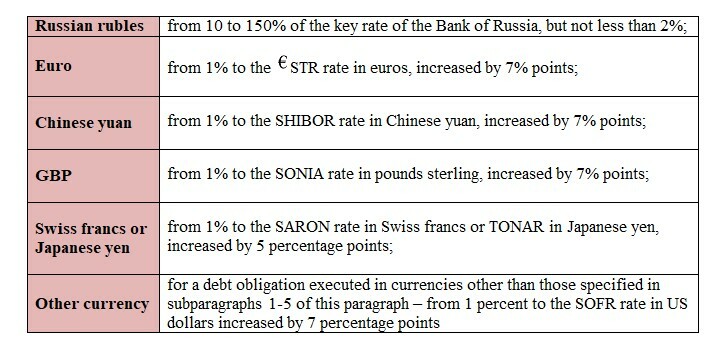

8. Making changes to “safe” intervals under Article 269 of the Tax Code of the Russian Federation

In essence, the proposed price control amendments for transfer pricing have three main objectives:

On this basis, it can be assumed that it is recommended at this stage for taxpayers to conduct a diagnostic of all their own controlled transactions and value chains (including on the foreign arm of such chains, if applicable) and determine the list of necessary changes to the applicable approaches to price discovery and to the documentation of controlled transactions, taking into account the proposed amendments.

As an additional measure to mitigate and control TP risks, one may consider entering into unilateral Pricing Agreement with tax authorities, including for cross-border transactions.

Given the proposed significant increase in penalties, the introduction of withholding tax and tax base adjustments to the median, the cost of non-compliance with the transfer pricing rules becomes very high and the practice can reach up to 50% of the tax base adjustment amount (excluding penalties).

We realize that the scope of the amendments is quite substantial, so we would be happy to discuss your situation and answer your questions, as well as assist in the area of compliance with the updated transfer pricing legislation.

As an additional measure to mitigate and control TP risks, one may consider entering into unilateral Pricing Agreement with tax authorities, including for cross-border transactions.

Given the proposed significant increase in penalties, the introduction of withholding tax and tax base adjustments to the median, the cost of non-compliance with the transfer pricing rules becomes very high and the practice can reach up to 50% of the tax base adjustment amount (excluding penalties).

We realize that the scope of the amendments is quite substantial, so we would be happy to discuss your situation and answer your questions, as well as assist in the area of compliance with the updated transfer pricing legislation.